In Fall 2022, American Express launched the ultra-exclusive, invite-only American Express Air Canada Card. At the time, there wasn’t too much information shared publicly aside from some of its benefits and perks, and most details about the card remained shrouded in secrecy.

Since then, more information about the card has surfaced, and I’d like to go over everything we know so far about the American Express Air Canada Card, and then see how it stacks up against what’s offered on other Aeroplan co-branded credit cards.

The Invite-Only American Express Air Canada Card

As an ultra-premium credit card, there is a lot of intrigue surrounding the American Express Air Canada Card. Here’s a rundown of what we know so far.

Qualification Requirements

First and foremost, it’s important to understand that the American Express Air Canada Card isn’t open to applications from the public. It’s an invite-only card, and American Express uses its own metrics to determine who does and doesn’t qualify for it, and these aren’t publicly known.

In a sense, the American Express Air Canada Card is akin to the American Express Centurion Card, in that it’s invite only and the qualification requirements are under wraps.

On online forums, many current cardholders of the American Express Air Canada Card have reported their approximate annual spending, which is usually well into the six-figure category, and sometimes more.

It’s likely that you need to have a history of high spending to qualify for the American Express Air Canada Card

It’s likely that you need to have a history of high spending to qualify for the American Express Air Canada Card

If you don’t put a significant amount of spending on an American Express Aeroplan Reserve Card each year, you’re unlikely to qualify for the American Express Air Canada Card. However, you also have the option to inquire by calling a number listed on the American Express website.

While you aren’t able to directly apply for the card (invitations are sent out on a rolling basis, and it sounds very much like a “don’t call us, we’ll call you” situation), the phone agents will provide a limited amount of information about the card and likely look at your account history, too.

Annual Fee

The American Express Air Canada Card has an annual fee of $2,500. Supplementary American Express Air Canada Cards also cost $2,500 per year, while supplementary American Express Aeroplan Reserve Cards cost $199 per year, and supplementary American Express Aeroplan Cards are free.

Notably, supplementary Air Canada Cardholders enjoy the full suite of perks, which we’ll dive into below.

Recall that the annual fee of the American Express Aeroplan Reserve Card is usually $599, and the American Express Aeroplan Card is $120.

Enjoy free supplementary American Express Aeroplan Cards with the American Express Air Canada Card

Enjoy free supplementary American Express Aeroplan Cards with the American Express Air Canada Card

Annual Spending Requirement

In order to maintain your eligibility for the American Express Air Canada Card, you must charge at least $150,000 per year to your card. Note that supplementary card purchases count towards this total, too.

If you fall short, your account may be cancelled and you’ll be offered an American Express Aeroplan Reserve Card instead.

Welcome Bonus

When I called American Express to inquire about the card, I asked whether or not there’s a welcome offer, and I was initially surprised to hear that there wasn’t. Of course, the agent could have withheld the available welcome bonus (if there is one), in keeping with the elusive nature of the card.

When the card first launched, we learned that the American Express Air Canada Card would share all of the features of the American Express Aeroplan Reserve Card, and that it would come with a number of additional enhancements (detailed below).

Therefore, I’d expect that if there were a welcome offer, it should at least be equivalent to what’s currently available on the American Express Aeroplan Reserve Card; however, I could also be totally wrong about this, and perhaps the targeted cardholders aren’t concerned about welcome offers with such high volumes of spending.

For that matter, there’s currently an excellent welcome offer available on the American Express Aeroplan Reserve Card.

American Express Aeroplan Reserve Card

- Earn 60,000 Aeroplan points upon spending $7,500 in the first three months

- Plus, earn an additional 40,000 Aeroplan points upon spending $45,000 in the first year

- And, earn 30,000 Aeroplan points upon making a purchase in months 15–17 as a cardholder

- Always earn 3x Aeroplan points on Air Canada purchases and 2x Aeroplan points on dining and food delivery

- Aeroplan preferred pricing, free first checked bag, priority check-in and boarding on Air Canada flights

- Unlimited Air Canada Maple Leaf Lounge access in North America

- Bonus Aeroplan points for referring family and friends

- No minimum income requirement

- Annual fee: $599

Automatic Aeroplan 50K Status

One of the most notable features of the American Express Air Canada Card is that new cardholders are automatically granted Aeroplan 50K status.

After the first year, basic and supplementary cardholders can maintain their Aeroplan 50K status by spending $50,000 on the card during their cardholder year (not the calendar year). Since you have to spend $150,000 on the card each year to maintain eligibility anyway, you’ll always enjoy 50K status if you’re an active cardholder.

Enjoy Aeroplan 50K status with the American Express Air Canada Card

Enjoy Aeroplan 50K status with the American Express Air Canada Card

Note that earning this level of status typically requires earning 50,000 Status Qualifying Miles or 50 Status Qualifying Segments, as well as $6,000 Status Qualifying Dollars. Alternatively, Aeroplan Super Elite members can choose to gift 50K status to someone as one of their Select Benefits.

As a reminder, Aeroplan 50K status provides members with a host of great benefits, including (but not limited to) the following:

- Star Alliance Gold

- Three free checked bags at 32kg each

- Priority airport services, priority boarding, priority baggage

- Complimentary preferred seats with eligible fares for domestic and transborder flights

- eUpgrades

- And more…

Comprehensive Maple Leaf Lounge, Air Canada Café, Signature Suite, and Priority Pass Access

Cardholders of the American Express Air Canada Card enjoy a vast array of lounge access.

You and a guest enjoy unlimited access to Air Canada Maple Leaf Lounges worldwide, Air Canada Cafés, and the Air Canada Signature Suites in the international departures area of Toronto Pearson (YYZ) and Vancouver (YVR) airports.

Access to Signature Suites is typically reserved for passengers flying on a paid business class fare or Business Class (Flexible) and First Class (Flexible) Aeroplan redemptions for Air Canada flights, as well as a select few other eligible passengers (Lufthansa Group HON Circle members on select flights, passengers travelling in Emirates, Lufthansa, or Swiss First Class).

Enjoy unlimited access to Air Canada Signature Suites as a cardholder of the American Express Air Canada Card

Enjoy unlimited access to Air Canada Signature Suites as a cardholder of the American Express Air Canada Card

As a cardholder, you can enter the Signature Suites at your leisure, which are quite often ranked amongst the best lounges in North America.

You’ll also benefit from a Priority Pass Select membership, offering you and a guest unlimited access to over 1,300 lounges in the Priority Pass network worldwide.

Signature Ground Services

Another unique benefit for American Express Air Canada Cardholders is that you get complimentary Signature Ground Services.

Notably, this includes access to the Air Canada Concierge team, who looks after travellers to ensure their experience is as smooth as possible.

Enjoy access to the Air Canada Concierge team as a cardholder of the American Express Air Canada Card

Enjoy access to the Air Canada Concierge team as a cardholder of the American Express Air Canada Card

If you charge an eligible round-trip business class or First Class ticket with a Star Alliance airline through the American Express Travel Concierge to your card, you’re eligible for complimentary chauffeur service within 50km of your departure and arrival airport.

Plus, if you’re connecting from a domestic to an international flight at Toronto Pearson (YYZ), you’ll enjoy Air Canada’s chauffeur service on your connection. If it’s available, a member from the Air Canada Concierge service will notify you in advance.

Enjoy Signature Ground Services as a cardholder of the American Express Air Canada Card

Enjoy Signature Ground Services as a cardholder of the American Express Air Canada Card

Other Air Canada Perks

The remainder of the card’s Air Canada-centric perks are aligned with what’s available on the American Express Aeroplan Reserve Card.

Upon spending $25,000 on the card in a cardholder year, you’ll earn an Air Canada Annual Worldwide Companion Pass, which offers a reduced base fare for a second passenger on a booking.

For every $5,000 spent on the card, you’ll earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment, which helps you reach or maintain Aeroplan Elite Status faster.

Your eUpgrades will have an extra year of validity, which means that they’re valid for two years from the date of issuance rather than the standard one year.

If you have unused Status Qualifying Miles at the end of the year, you can roll over up to 200,000 SQM to give yourself head start on earning status (and Threshold Rewards) the following year.

You and up to eight passengers travelling on the same booking will benefit from a free first checked bag (23kg), as long as the first flight is operated by Air Canada. (Note that if you have Aeroplan 50K status, your baggage allowance is higher.)

Earning Rates

The American Express Air Canada Card has a three-tiered earning rate, outlined as follows:

- Earn 3 Aeroplan points per dollar spent on eligible Air Canada expenses

- Earn 2 Aeroplan points per dollar spent on eligible dining and food delivery purchases in Canada

- Earn 1.25 Aeroplan points per dollar spent on all other eligible purchases

It’s worth noting that these are the same earning rates as the American Express Aeroplan Reserve Card.

Insurance Coverage

As an ultra-premium card, the American Express Air Canada Card comes with a comprehensive list of insurance coverage:

- Emergency medical insurance: 15 days of coverage for up to $5,000,000 per insured person per trip, if under the age of 65

- Travel accident insurance: up to $1,000,000

- Trip cancellation: up to $1,500 per insured person per trip; maximum $3,000 combined for all insured persons

- Trip interruption or trip delay: up to $1,500 per insured person, per trip; maximum $6,000 combined for all insured persons

- Flight delay: up to $1,000 per occurrence for all insured persons combined with baggage delay on flight delays of four hours or more

- Baggage delay: up to $1,000 per occurrence for all insured persons combined with flight delay on baggage delays of six hours or more

- Lost or stolen baggage: up to $1,000 per occurrence for all insured persons combined

- Car rental theft and damage: up to 48 consecutive days; MSRP up to $85,000

- Hotel burglary: maximum $1,000 per occurrence for all insured persons combined

- Buyer’s assurance: maximum $10,000 per item; not to exceed $25,000 per cardmember per policy year

- Purchase protection: maximum $1,000 per cardmember per occurrence; covers theft or damage within 90 days of purchase

From what I can tell, it appears that the insurance coverage on the American Express Air Canada Card is identical to that on the American Express Aeroplan Reserve Card.

Other Perks

From what we can tell, the American Express Air Canada Card comes with a number of other perks and benefits.

On the American Express website, it lists “Gain insider access to special events and experiences, including some only available to American Express Air Canada Cardmembers” as one of the card’s benefits.

Plus, you’ll have access to the American Express Lifestyle Concierge, which is a network of professionals who provide tailored services around the world. This team can help with booking reservations at exclusive restaurants, finding tickets to events, and a host of other experiences both at home and abroad.

The American Express Aeroplan Reserve Card also comes a suite of benefits at Toronto Pearson (YYZ), which are also available to American Express Air Canada Cardholders:

- 15% off parking rates at the Express Park and Daily Park, as well as 15% off Car Care services at Toronto Pearson (YYZ)

- Complimentary valet service at Express Park and Daily Park at Toronto Pearson (YYZ)

- Access to the Priority Security Lane in Terminals 1 and 3 at Toronto Pearson (YYZ)

There very well may be more perks and benefits offered to cardholders; however, until a member of the Prince of Travel team is invited to the card, these will have to remain a mystery.

Is the American Express Air Canada Card Worth It?

As an invite-only card with a premium $2,500 price tag and a hefty $150,000 annual minimum spending requirement, the American Express Air Canada Card is amongst the most exclusive cards available to Canadians (and arguably one of the most difficult to maintain).

Indeed, part of the card’s allure is simply that it’s out of reach for the vast majority of people, and you have to be invited to the card after reaching an unknown set of qualification criteria.

As is always the case with premium credit cards, whether or not it’s worth the annual fee will boil down to how much you can leverage the card’s benefits and perks above and beyond what you can get from the publicly available Aeroplan premium co-branded credit cards.

Premium Aeroplan Credit Cards

In my opinion, the American Express Air Canada Card is a slam dunk for someone without Aeroplan Elite Status who travels often and almost exclusively on international Aeroplan redemptions, especially in economy.

This way, you’re leveraging the card’s best benefits (Signature Suite lounge access in any class of service, as well as lounge access when flying in economy by way of Star Alliance Gold through Aeroplan 50K status).

With access to the exclusive Air Canada Signature Suites, you wouldn’t have to meet the usual entry requirements and could, for example, enjoy the lounge when travelling on an Air Canada economy or premium economy ticket booked with Aeroplan points. (For that matter, with 50K status you’d have eUpgrades to apply to the booking, and hopefully you’d clear the waitlist and take to the skies in business class).

Signature Suite access is a great perk with the American Express Air Canada Card

Signature Suite access is a great perk with the American Express Air Canada Card

However, it’s rather difficult to imagine there being a high-enough volume of these individuals, as it’s more likely that the card targets individuals who fly frequently enough with Air Canada to earn status organically, or who fly on paid business class tickets to begin with.

In these cases, you’ll already enjoy many of the card’s perks through your Elite Status or by travelling on a paid business class ticket (Signature Suite access, Concierge team, “surprise & delight” ground service), and the card’s annual fee may not be justified (aside from the allure of having an invite-only card).

At the same time, paying $2,500 for the supplementary cardholder(s) to have 50K status is a great perk, and it represents one of the “easiest” pathways to Aeroplan 50K status and Star Alliance Gold (while acknowledging that the invite-only nature of the card makes this inaccessible to most).

Supplementary cardholders enjoy access to over 1,000 lounges worldwide with Star Alliance Gold

Supplementary cardholders enjoy access to over 1,000 lounges worldwide with Star Alliance Gold

For the most part, I’d say that the American Express Aeroplan Reserve Card can provide outsized value to Air Canada frequent flyers on an ongoing basis through its many perks and benefits that are shared with the American Express Air Canada card, and the jump up to the American Express Air Canada Card may not be justified.

In my opinion, some of the benefits offered on the US-issued Chase Aeroplan Card would make for great enhancements to the American Express Air Canada Card, including the Level Up benefit and the Global +1 benefit.

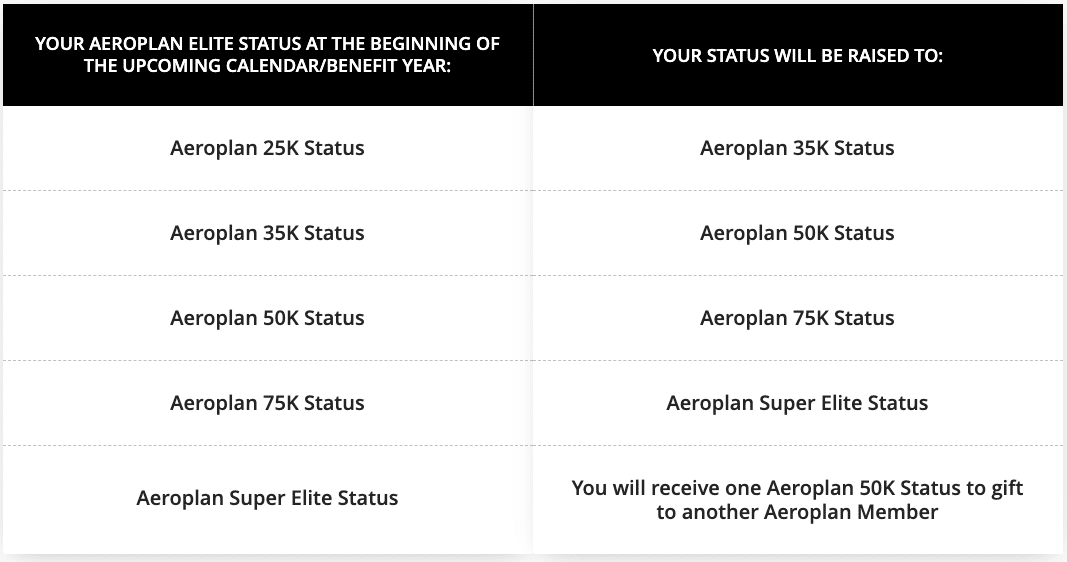

As a reminder, the Level Up benefit gives you a one-tier boost from the status you’ve organically qualified for by spending $50,000 (USD) in a calendar year.

For example, if you organically qualify for Aeroplan 75K status and spend $50,000 on your Chase Aeroplan Card in a calendar year, you’ll enjoy top-tier Super Elite status the following year. This is an outstanding benefit, and it offers the easiest path to Super Elite status.

Meanwhile, the Global +1 benefit is earned upon spending $1,000,000 (USD) on your Chase Aeroplan Card in a calendar year. Once available, you can designate a companion and they’ll get the base fare in points returned when you make a redemption for two in any class of service.

In other words, when you make an Aeroplan redemption for yourself and your designated companion, the Global +1 benefit will refund the points you redeem for your companion. Since this covers any class of service (including business class and First Class), this is an extremely powerful benefit if you can make good use of it.

Once again, it goes to show how incredible the Chase Aeroplan Card is (especially when you consider its measly $95 annual fee), and it’d be great to see these benefits (and perhaps more) ported over to the American Express Air Canada Card to increase its attraction to Air Canada frequent flyers and high spenders.

Let Us Take Care of You

If you’re an Air Canada frequent flyer looking to maximize the benefits of the Aeroplan Elite Status program, Aeroplan points, eUpgrades, and more without putting in all of the work yourself, head over to the Prince of Travel Concierge website to learn more about our white-glove service.

Our expert Concierge account managers will look after everything on your behalf: crafting a comprehensive credit card strategy, ensuring you’re earning elite status and leveraging all of the benefits, redeeming points for maximum value, and saving you time and money on booking travel.

Learn More about Prince of Travel Concierge

Conclusion

The ultra-exclusive American Express Air Canada Card is available on an invite-only basis.

It comes packed with exclusive perks, including Aeroplan 50K status, generous lounge access, and much more – all for the price of $2,500 and the requirement of spending $150,000 per year.

If you receive an invitation, be sure to weigh the card’s many benefits against the cost, as well as what you already enjoy through your status, travel habits, or credit cards.

Please visit:

Our Sponsor